Condo Insurance in and around Houston

Houston! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Your Stuff Needs Insurance—and So Does Your Condo Unit.

Looking for a policy that can help insure both your condominium and the books, pictures, electronics? State Farm offers excellent coverage options you don't want to miss.

Houston! Look no further for condo insurance

Quality coverage for your condo and belongings inside

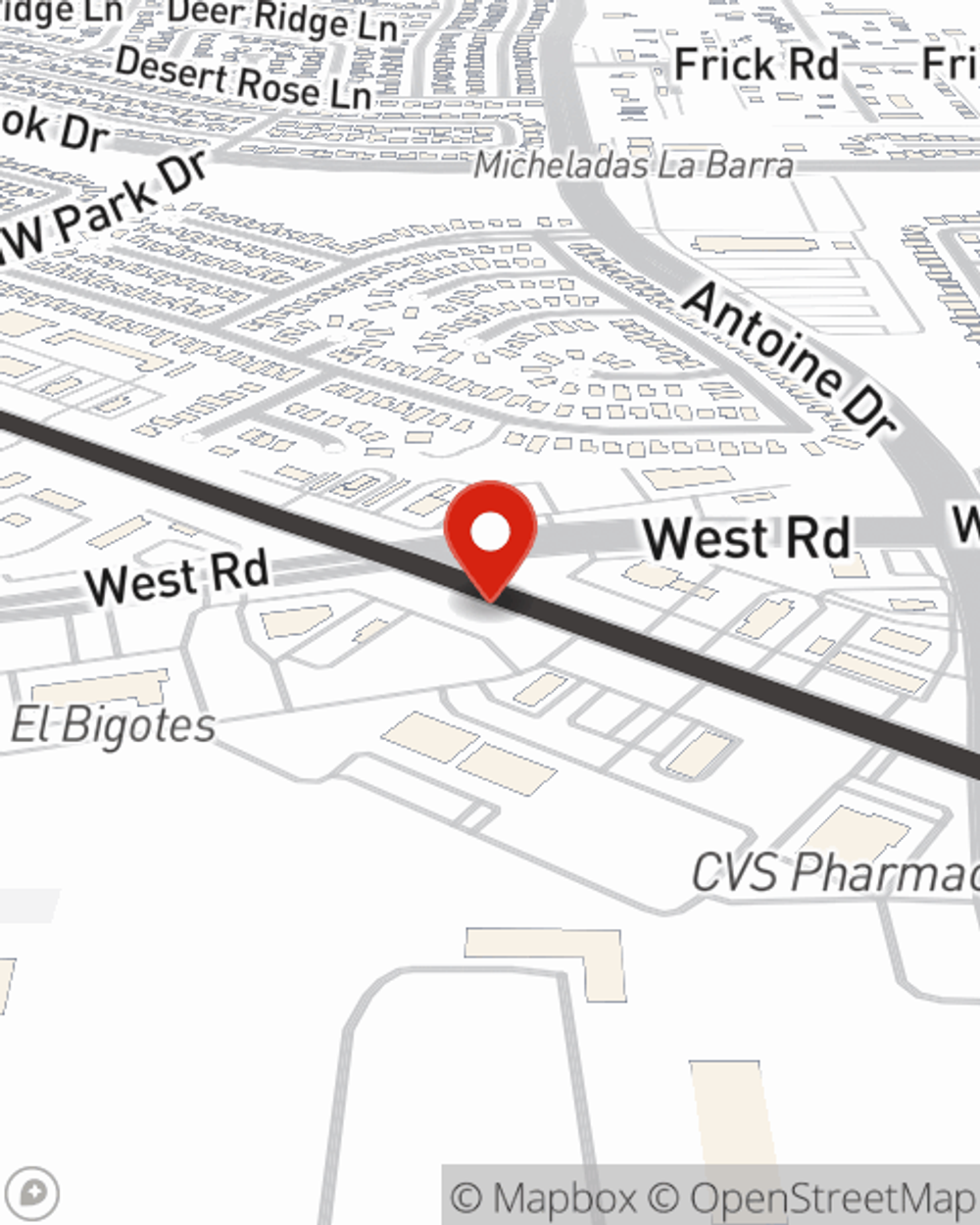

Agent Hien Apple, At Your Service

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from water damage, a windstorm or vandalism.

Intrigued? Agent Hien Apple can help you understand your options so you can choose the right level of coverage. Simply visit today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Hien at (281) 890-8822 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.